One interesting fact that you might not know is that the Big G (that is, Google) decided several years ago to power 100% of its activities using renewable energy.

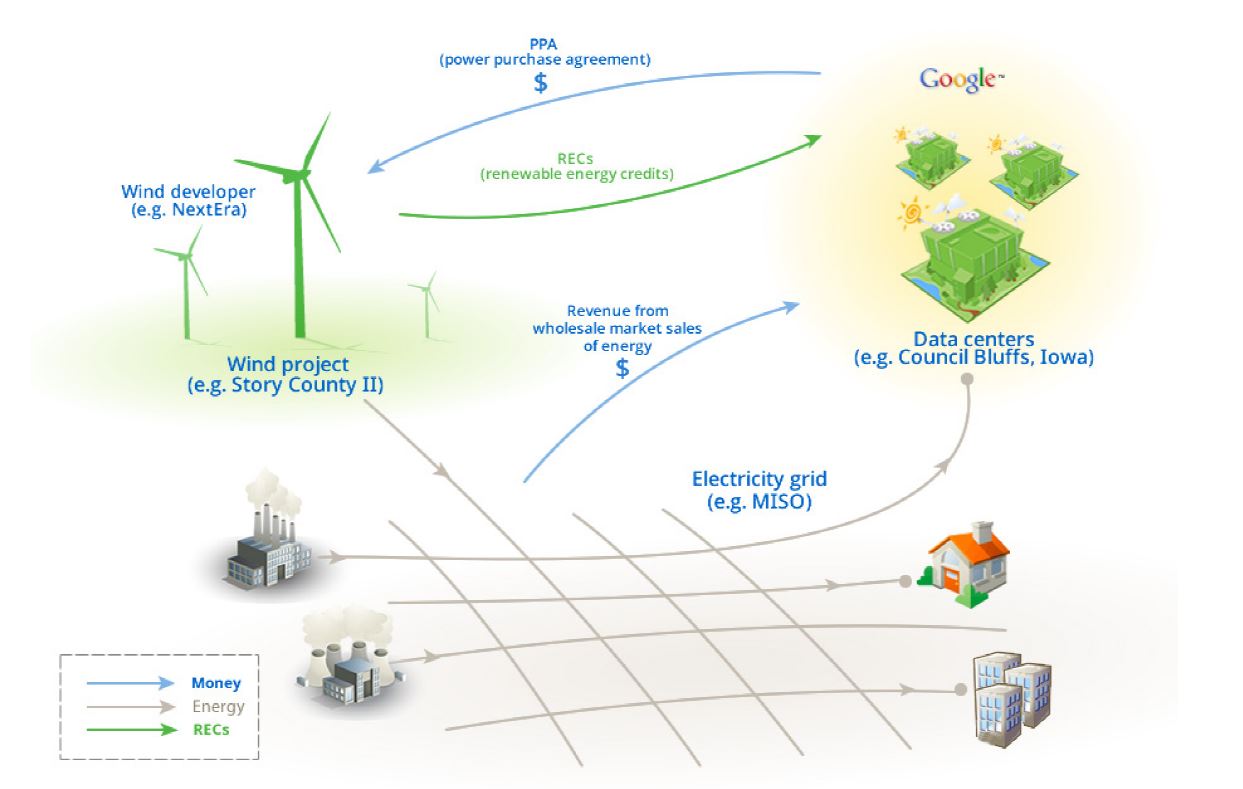

They reached their objective in 2017: what is surprising is that they started only in 2010, with a wind farm in the USA. Basically the strategy is to close Power Purchase Agreements with developers, aiming at investing in “additional” production.

“Additional” means that they don’t want only to buy renewable energy: they want to add this MW to the grid, building new plants and lowering the carbon footprint.

Another interesting fact is that they buy renewable plants connected to the same grid were the data centres are.

For instance their very first PPA was for a 114 MW windfarm in Iowa, one of the states with a data centre, while their 72 MW wind project in Sweden (2013) was intended to “feed” the data centre in Finland.

The next step is to sell power to the grid at the spot price. Here is where the magic happen: Google is willing to sell it at a loss in case the spot price is lower than the price indicated in the PPA. The idea is that they wanted to use their financial power to give developers a steady cash flow, assuming the risk of fluctuations in prices.

They also get the famous “renewable energy credits”, and they use them to offset the carbon footprints of the data centres.

A legitimate question would be “Why don’t you buy directly the renewable energy credits?”. The position of Google, as mentioned before, is that they want to help developers to create more and more renewable energy plants. They believe that the best way to do it is to use their deep pockets to make more projects reality – “bankability”, the possibility to get the money to finance a project from a panel of bank, is usually one of the critical point that kills many developments.

The good news, at least for people like me in the wind business, is that the vast majority of the investments (>95%) are in wind farms. The same apply to other business giants following Google on the renewable path, such as Amazon, Microsoft and Facebook.

Leave a Reply